Kip M. Twitchell © 2024 All Rights Reserved. This paper was presented at the 2024 BYU Accounting Research Symposium on September 20, 2024.

Abstract

Today’s shared ledgers are based upon lack of trust between parties, making them less efficient than existing systems. But even proprietary legacy systems involve no trust between parties. As trust is a measure of efficiency, both systems may be improved by focusing on potential uses in high-trust environments. Such use may lead to social commerce platforms, providing many benefits to society.

Introduction

While the radical concept of a shared ledger between all stakeholders in a transaction is far-reaching, much of blockchain is about lack of trust between counterparties. The “trustless-ness” of blockchain explains much of its inefficiencies.

Trust is one measure of efficiency. A shared ledger in a highly trusted environment has the potential to (1) reduce record keeping costs, (2) increase data quality for all stakeholders, (3) open new efficiencies for the trustworthy participants, and (4) greatly expand the power of record keeping to underserved populations.

The proprietary nature of legacy systems means they require no trust; each party to the transaction maintains their own highly secured records. This trustless-ness signals an opportunity for greater efficiency and lower costs over today’s legacy systems. Yet the inefficiency of today’s shared ledgers—and resulting high costs—prevents them from displacing legacy systems.

Experimentation with cost-effective shared ledgers in a highly trusted environment may capture all the above benefits. Administration of fast offering funds may provide just such an effective test bed, leading to the development of social commerce platforms to the generalized benefit of society.

Legacy System Impediments

In January 2018, thirty years after my BYU accounting program introduction to McCarthy’s REA,[1] I published “A Proposed Approach to Minimum Costs for Financial System Data Maintenance.”[2] During my education, Dr. Eric Denna fired my imagination about potential innovation in financial systems,[3] as I’ve written in chapter 1 of my textbook about the theory:

McCarthy’s papers generated a body of academic work over twenty-plus years. [The theory] could greatly simplify the business information systems architecture of the world. . . . Early proponents went so far as to call for a revolution in accounting systems architecture . . . but the fortress of accumulated lines of code and embedded business processes repulsed the attack.[4]

My 2022 paper, “Transformation of Business and Financial Platforms: What We Must Understand to Renew Existing Systems,” documents some of the reasons business ledgers have not been transformed by blockchain—for example, because it lacks fundamental ledger posting processes.[5]

Shared Cost Savings

Even with the shortcomings of blockchain, in 2021 the potential power of a shared ledger inspired me to start a non-profit dedicated to exploring the concept, called Sharealeger.org. This collaborative project seeks to reverse the lack of innovation in business systems and to improve society in the process. Doing so requires sharing information about ledgers, regenerating long-forgotten knowledge embedded in all major business systems today, and considering whether sharing data among organizations might spark a new round of improvements.[6]

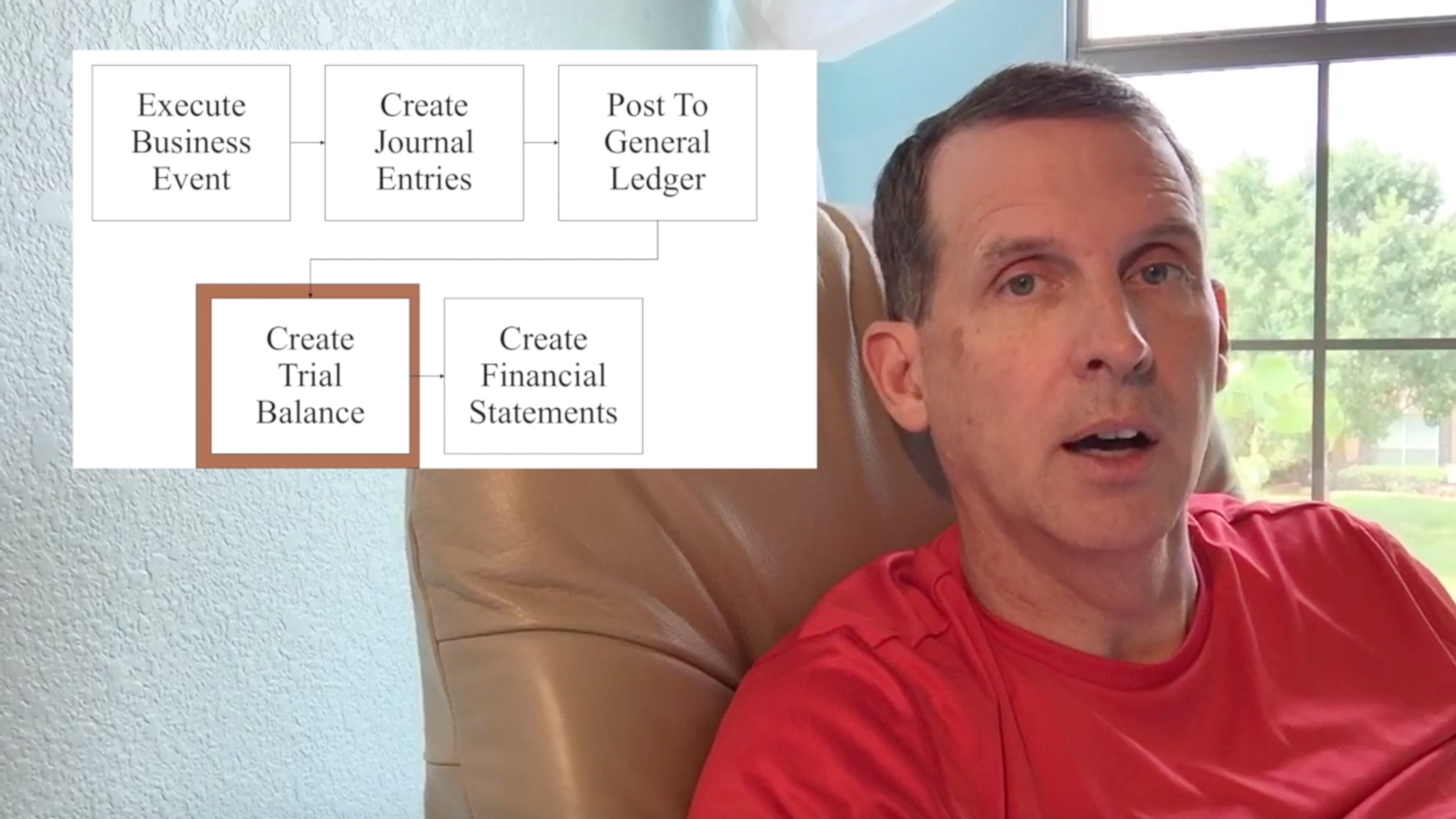

A shared ledger may reduce the cost of recording and increase the accuracy of financial data because proprietary systems must be reconciled to each other to be considered trustworthy. For example, the highest form of audit evidence is independent validation of a balance. Accounts receivable that are not acknowledged by customers are suspect, as are bank account balances with discrepancies and accounts payable not verified by vendors.[7]

At its highest levels, transactional record-sharing between parties on a shared ledger may significantly reduce the cost of clerks, as coding, correction, verification, and many other functions would be shared between the two parties.

In fact, the number of transactions that may be needed by each party and their respective banks might be reduced dramatically. For example, a typical order of goods can involve ten different transactions recorded by all the parties, which might be reduced to three in a truly shared ledger.[8]

Shared Trustless-ness

Systems that are trustless by design are inefficient by design.

In a highly trusted relationship, such as in a family, pencil and paper have adequate security to record transactions in a ledger. In a slightly less trusted environment, such as a partnership, one might choose to use pen and ink, making things a bit harder to change.

Blockchain is like using a slab of granite anchored in a mountain and a jackhammer. Only in that way would one party have confidence that when they are asleep each night, the counterparty won’t be able to sandblast the slab clean and re-chisel it with a fictitious set of transactions. But this “trust” costs huge amounts of compute capacity to record each transaction all day long.

Fundamentally honest people—the “trustworthy”—have a significant competitive advantage over criminals. As I predicted in 2019, “Blockchain in Bitcoin is effective for transactions with criminals but will never replace the efficiency of today’s trusted systems of records.”

A trust-based, shared-ledger can make today’s systems of record even more efficient.[9]

The Power of Trust

Because the love of money is the root of all evil (1 Tim. 6:10), it is commonly held that unmitigated trust is impossible in financial matters. I find such thinking often indicates a lack of integrity. Money is an amazing technology, generating incredible efficiencies in our societies. As Ralph Waldo Emmerson (1844) said “Money, which represents the prose of life. . . is, in its effects and laws, as beautiful as roses.”[10] And yet virtues are even more powerful.

In 2011, I faced serious struggles in my work. In a conversation with a senior executive, I wondered aloud if someone who is fundamentally honest is at a competitive disadvantage when negotiating a contract. He found the question interesting and asked what I had concluded. I wasn’t sure yet.

The answer came months later: Honesty is a serious competitive advantage, as an honest person can accomplish things a dishonest person could never do, like creating customer agreement with an efficiency that is impossible without trust between the parties. Honesty replaces textbook-size contracts with a simple handshake.[11]

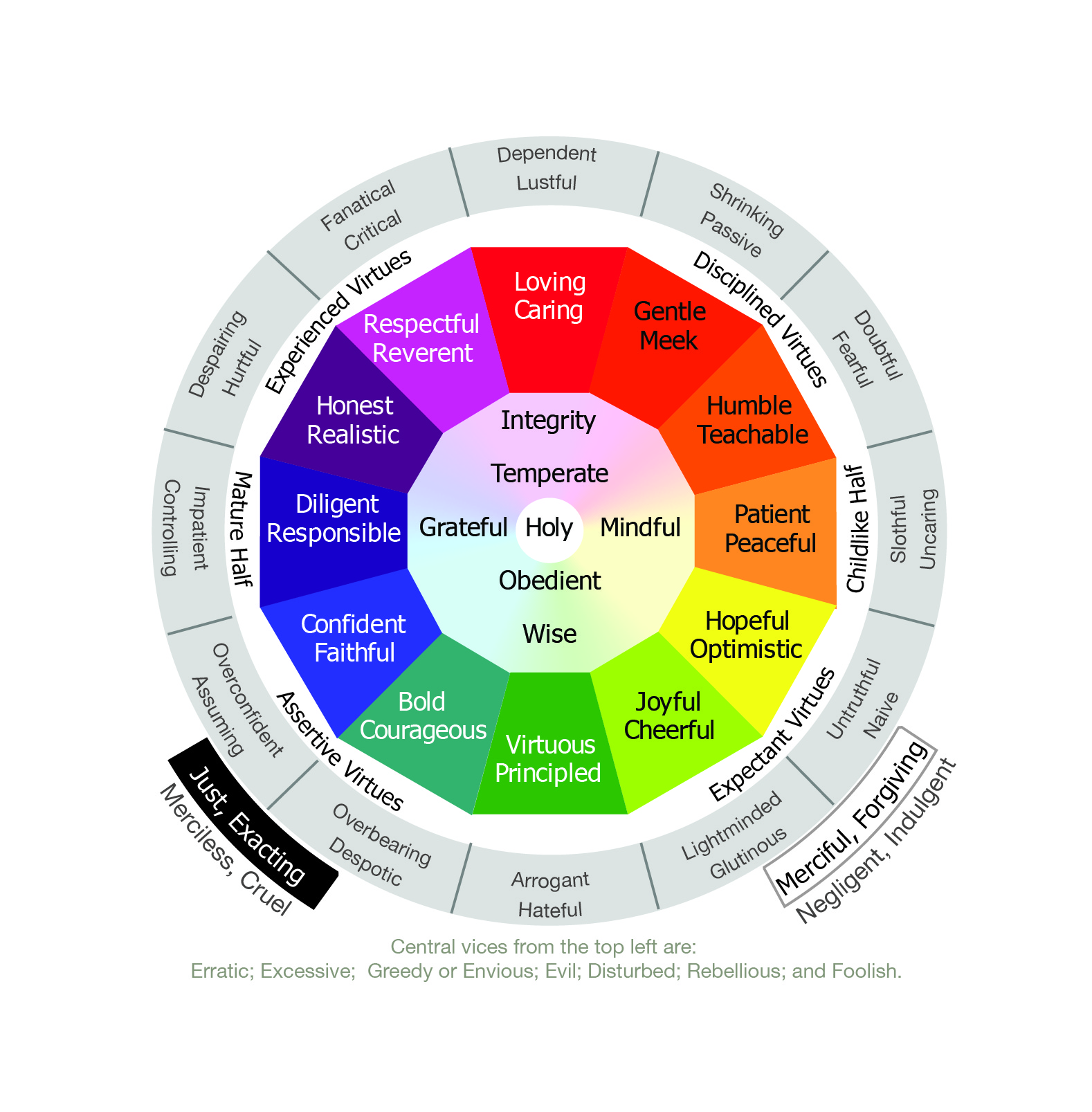

The dishonest justify their behaviors by believing no one is truly honest. But fundamentally trustworthy individuals know other trustworthy individuals exist. And when they connect, incredible things happen—things which cannot even be imagined by the dishonest. These insights sparked my study of virtues and creation of VirtueWheel.com to explore the power and relationship of virtues.

Integrity in Bookkeeping

Luca Pacioli, who documented bookkeeping said in the first page, “In the business world, nothing is consider more important than the word of a reputable businessman. Promissory notes are honored and accepted based upon a businessman’s reputation. Confidence, faith in reputable businessmen, is what makes the market effective. This is not really strange, for the faith of a Christian in God works in much the same way to make religion effective.”[12]

It is very clear that bookkeeping, good bookkeeping, was a means of increasing respect and confidence of others in the businessperson. We all want to do business with people who remember their commitments, who do what they say they will do, who track accurately our interactions, and who correct mistakes quickly if they are made.[13]

There is a natural relationship between bookkeeping and measurement of virtues, springing from the same intellectual history, as described by Alfred W. Crosby in “The Measure of Reality: Quantification and Western Society, 1250 – 1600” The book ends by describing the far-reading impact of the invention of bookkeeping, but the origins of that technology started as society developed ways of measuring things.

“What can be measured in terms of quanta is not as simple as we…think. For instance, when in the fourteenth century the scholars of Oxford’s Merton College began to think about the benefits of measuring not only size, but also qualities as slippery as motion, light, heat and color, they forged right on, jumped the fence, and talked about quantifying certitude, virtue, and grace. Indeed, if you can manage to think of measuring heat before the invention of the thermometer, then why should you presumptively exclude certitude, virtue, and grace?”[14]

The Simplest Shared Ledger

Imagine the simplest shared ledger: a shared online spreadsheet, like a Google Sheet, accessible by all stakeholders to the shared set of transactions. In the highest trust and integrity environment, all parties would acknowledge each transaction, perhaps simply by marking their assigned column with an X. They would never mark in another party’s column.

All would commit to never change any transaction so marked. Rather, they would always add new transactions to adjust for errors or other needs, making the ledger immutable through integrity and nothing more. Such an environment would require no mining, proof of work, or proof of stake. The compute costs for such a system would be minuscule. Such a ledger involves no cryptocurrencies, being simply the transaction record of settled currencies or mediums of exchange. But all parties would benefit from increased transparency, accuracy and accessibility of the high-quality financial information.[15]

The Power of Consecration

Just like those in a feudal economy could not imagine the efficiencies available in a capitalist economy (even with its limited levels of trust), most in our world today cannot imagine the greater efficiencies possible in what might be termed a consecrated economy.

Although religions are effectively hospitals for the morally ill (1 Timothy 1:12-17), they universally strive to educate members about the value of honesty and integrity. While their efforts are not perfect, they may provide a place for testing the value of shared ledgers.

The sacred writings of my own religious tradition, The Church of Jesus Christ of Latter-day Saints, contain many references to financial matters. One of the most fundamental is the definition of funds to be used in the Church. Today, members would recognize two major categories of funds maintained by the Church: tithing, and fast offerings. Tithing donations are given to local leaders who transmit them directly to the Church headquarters, where the presiding councils determine uses. [16]

Fast offerings are given when members fast and donate the value of the food they would have eaten at a minimum. These funds are distributed by the bishop of the ward (pastor of the congregation) using the following welfare principles: meeting temporary needs; providing goods and services necessary to sustain life that are common to most members of the ward; and providing opportunities to work (to the extent of the recipient’s ability) for the assistance received;[17]

Specifics as to how both funds should be managed are described in D&C 104:54–75, which instituted the first “sacred treasury” (or tithing) to be used for the printing of the scriptures. Then verses 67–75 defines a “common consent” treasury, or what today we would call fast offerings.

And again, there shall be another treasury prepared, and a treasurer appointed to keep the treasury, and a seal shall be placed upon it;

And all moneys that you receive in your stewardships, by improving upon the properties which I have appointed unto you, in houses, or in lands, or in cattle, or in all things save it be the holy and sacred writings, which I have reserved unto myself for holy and sacred purposes, shall be cast into the treasury as fast as you receive moneys, by hundreds, or by fifties, or by twenties, or by tens, or by fives.

Or in other words, if any man among you obtain five dollars let him cast them into the treasury; or if he obtain ten, or twenty, or fifty, or an hundred, let him do likewise;

And let not any among you say that it is his own; for it shall not be called his, nor any part of it.

And there shall not any part of it be used, or taken out of the treasury, only by the voice and common consent of the order.

And this shall be the voice and common consent of the order—that any man among you say to the treasurer: I have need of this to help me in my stewardship—

If it be five dollars, or if it be ten dollars, or twenty, or fifty, or a hundred, the treasurer shall give unto him the sum which he requires to help him in his stewardship—

Until he be found a transgressor, and it is manifest before the council of the order plainly that he is an unfaithful and an unwise steward.

But so long as he is in full fellowship, and is faithful and wise in his stewardship, this shall be his token unto the treasurer that the treasurer shall not withhold.[18]

With this simple fund administration, members can choose to be fully consecrated. The fund is effectively a collective savings account. I believe members of the Church will have increased opportunities to live the law of consecration, perhaps requiring better financial systems.[19]

Begin with Transparency

If the fast offering “treasury” is effectively a collective savings account, then fully living the law of consecration would likely increase donations. Disbursements would also significantly increase, depending on members’ cash management abilities. The current fast offering system is likely challenged to comply with this portion of the commandment, “Until he be found a transgressor, and it is manifest before the council of the order plainly that he is an unfaithful and an unwise steward.”

In fact, the current system does not even allow distribution of cash to individuals, thus recipients are not accountable for their use of the funds. But as Giving Directly notes, “Many people (including us) grew up hearing that ‘you can’t just give money to poor people.’ As it turns out, this view was largely based on anecdote and hearsay; the first rigorous experiments testing this approach (and many others) did not begin until the 1990s. Since then we have learned an enormous amount about the impacts that cash transfers have had on the lives of people living in poverty, with over 300 studies from around the world.”[33]

This is a problem of transparency that a shared ledger can easily help correct. Imagine if the only change to our existing systems was that instead of disbursing funds to an individual’s bank account, the funds were disbursed to the members’ “stewardship” bank account. The member would have all the capabilities of their personal bank account, but the bishop and any designee would have access to view all transactions.

Such a system would immediately provide the information needed to teach members about the processes of financial management. For example, if the member runs a home-based business and purchases supplies at the local convenience store using the stewardship account, an experienced mentor may be able to identify and recommend cost savings by using a lower-cost vendor.

Such a system uses the efficiency of existing financial and banking systems (without proof of work or proof of stake costs) but begins to increase the value of the captured data to participants.

Next: Better Record Keeping

A well-known quote from Church President Thomas S. Monson is a centerpiece of the missionary handbook Preach My Gospel: “When performance is measured, performance improves. When performance is measured and reported, the rate of improvement accelerates.”[20]

In 2017, the Church’s First Presidency issued the Starting and Growing My Business for Self-Reliance manual to help increase member’s self-reliance. Of the twelve chapters, half require some type of financial record keeping.[21] While taking the class amid a period of deep personal R&D work on financial ledgers, I was shocked to consider that although many poor merchants in the world now own computers—in the form of a smart phone—and have access to a plethora of tools for publishing and communicating and a host of other functions, there are no ubiquitous tools for financial recordkeeping.[22]

The next step in assisting members includes enhancing the “stewardship” account to provide simple record keeping for small business owners, enabling the power of accurate record keeping.[23]

Sharealedger.org Vision Statement

These insights led to the founding of Sharealedger, and collaboration with other like-minded individuals has resulted in Sharealedger’s vision statement:

Vision: To bring 1 billion people into the digital economy, not just through transaction payments and receipts, but also with financial management capabilities that allow them to measure what they do well, what they don’t do well, how to contribute to society better, and how to prepare for the future.

The types of tools by which this will be done are all effectively known today:

- Inexpensive cell phones which are the personal computers for even the world’s poorest

- Internet mobile technology services, similar to Facebook, Google, Twitter, and Amazon

- Mobile payment and receipt systems, like Venmo or Zelle

- Ubiquitous financial tracking databases, available with blockchain

Impediments: The impediment to this capability today is the fragmented and proprietary nature today’s financial systems and data.

- Financial data is maintained in many places in propriety forms by various intermediaries who provide little help to individuals in financial management.

- Financial data management is tedious, often unautomated, and requires specialized knowledge.

- Categorization of financial data, which is key to understanding finances over time, is a clean-up activity, done post-authorization rather than at transaction time (i.e., payment or receipt).

- Reconciliation with counterparty ledgers (bank, vendors, customers) consumes large amounts of resources if attempted.

Innovation: Sharing financial data with authorized counter- and interested parties has the greatest potential to overcome these impediments. Sharing financial data:

- Potentially reduces costs to each party because actions taken by one are shared

- Increases accuracy of the resulting ledgers with the natural check a counterparty

- Demands data be moved from propriety locations, increasing ownership by primary partners

- Eliminates the need for reconciliation and other wasted processes

Cost: Cost is critical to such a system, particularly for widespread use by those most in need.

- The demanding data standard for financial data is accuracy over long periods.

- Reductions in computing costs must not be wasted on inefficient, sloppy code.

- System efficiencies cannot be added later; the system must start with performance at scale.

- Reaching a billion people requires reductions in today’s costs by hundreds or thousands of times.

Data: Computer processes have increased efficiencies when they have increased consistencies; therefore, identifying fundamental data organizations is key. Recently developed ubiquitous internet technologies demonstrate the power of such a concept.

- Search engines are fundamentally organized around URLs.

- Social media platforms are organized around posts.

- Online retailers are organized around products or SKUs.

- The fundamental data organization for any financial system is composed of a set of balances, which reflect positions as of a point in time, and the full set of transactions which gave rise to those balances.

Uses: With a system organized around such data, users will be able to:

- Swipe right or left to scroll through a set of balances over time

- See transactions and changed balances in those periods

- Initiate new transactions based upon those balances

- Aggregate balances to create higher-level understandings over time and better comprehend their financial world through consistency of the balances and transactions

Legal Requirements and Liability

The Sharealedger non-profit was created as a potential open-source community to create this software. Open-source models of software development have proven extremely successful, although the proprietary nature of financial systems have resulted in fewer large projects. Creating open-source solutions would allow for customizations for various regulatory entities and geographies. They would also enable transparency of functions for government oversite.[24]

D&C 51:5–6 says:

“And if he shall transgress and is not accounted worthy to belong to the church, he shall not have power to claim that portion which he has consecrated unto the bishop for the poor and needy of my church; therefore, he shall not retain the gift, but shall only have claim on that portion that is deeded unto him. And thus all things shall be made sure, according to the laws of the land.”

It seems prudent that the “stewardship” accounts are not owned by the Church but by the member, thus ensuring the laws of the land are followed, including responsibility for taxes and legal compliance. Accounts could be granted through Church membership, allowing transparency without requiring Church responsibility.

Data Perspectives

The proposed shared ledger does not require triple-entry accounting. “The double-entry method can be extended to a form of triple-entry accounting by adding a signed third entry to a public ledger.”[25] In my proposed shared ledger, the primary transaction is shared by both parties and not duplicated elsewhere, which would require another form of reconciliation for adding costs.[26]

Yet this shared transaction is not the only data needed for financial management. Each stakeholder requires additional data to interpret the shared transaction. For example, a payment from one party to another would be viewed as a disbursement to one and a receipt to the other. I have proposed approaches to these individualized perspectives, as well as mockups of systems that would allow parties to initiate a shared ledger.[27]

Cryptocurrencies

None of the above requires any type of cryptocurrency. It is all purely financial record keeping.

Of course, a high enough concentration of trading partners on a shared ledger would result in netting of payments, perhaps a simple form of cryptocurrency. Even if other currencies develop, trust will still be integral to their stability. Currencies have always been interlinked with trust.

When we have trust, we have predictability, and currency is all about predicting the future. Currencies are fundamentally transferrable credit. That’s how currency starts. Someone accepts an IOU, and that person can pass on that IOU to someone else. In this process, risk assessments become necessary: will this currency—or this promise of repayment—be worth anything tomorrow?[28]

In modern times, currencies have been issued by governments because they were viewed (for the most part) as trustworthy. When they are not, the currency becomes worthless. The Church’s experience with the Kirtland Safety Society is very relevant. As the Church tried to establish currencies for members in the 1830s—amid many, many competing currencies with differing qualities of trustworthiness—its institutional credibility prevented it from being successful.[29]

The most cost-effective control against double spend of a cryptocurrency is the integrity of the holder, of course assisted by careful recordkeeping, as high integrity people always track commitments. Any tooling should assist them in doing so. As the world begins to experience diversification of currencies and payment options, it is likely that few will be willing to restrict their purchasing ability to a single currency. The shared ledger must enable recordkeeping from multiple exchange networks.

Trying to divorce currencies from trust is like trying to separate weather from the atmosphere.[30]

Social Commerce Platform

Although consecration and fast offerings provide a basis for the development of this platform, the platform itself would be useful for any economic transaction completed by people committed to honesty and transparency. Social media has shown the ability to create communities that transcend geographic locations. It is therefore natural to assume that like-minded individuals will want to form tighter connections even in commercial situations.

In any society, a small but profitable segment of the population will believe in and practice trustworthiness and integrity. A simple measurement of the commitment to these ideals today is a credit score. Data undergirding high credit scores will become more and more transparent through shared ledgers, giving adherents increasing efficiencies.

This data will lead to social risk pool management. For example, individuals will be willing to allow trusted algorithms to access their personal financial and tax data to determine their social credit score, which they will expose to potential partners. These high-value risk pools will effectively be managed by participants themselves rather than a centralized banking entity, democratizing credit creation.

Advanced Social Commerce Groups

Individuals in these high-value risk pools will accept IOUs from other members. If the pool becomes large and diverse enough, they will issue their own IOUs, creating a group currency with assigned values to physical objects exchanged. Over time, the group will establish exchange rates into and out of its currency with banking functions.

Audit processes will consider total issued currency for every individual against known assets and other forms of debt. Micro-lending and crowd-sourcing will become common, and some will focus on social agendas like poverty alleviation. Rules for government taxation and regulation will develop, as well as consumer protection.

Some groups will become overextended, and currencies will fail. Fraud will be committed, and all the other aspects of modern commercial society will be enabled on the platforms. But well-managed risk pools will thrive and have the lowest transaction and credit costs for high-integrity members.

Foundational to all this will be accurate financial data, owned by stakeholders, shared in authorized ways, highly secure in efficient ways.[31]

Operating Costs

The costs of such an environment will be covered in a multitude of ways, from customers providing access to their data for free use of the platform, to existing payment mechanisms of fees for use. All of today’s financial system funding will become possible sources for the platform in time.

Additionally, platforms themselves may offer incentives to risk pool organizers for effective management of the pool. These incentives would speed democratization of credit and adoption of the platform, particularly among those of lower economic status. Initial opportunities for deployment of a system in some places might come through emergency responses to natural disasters, providing the first form of very simple electronic commerce.[32]

Conclusion

The direction of financial system innovation contemplated by this paper seems likely given the natural progress of the world to greater and greater wealth through broader-based application of virtues. Application of the same virtues fundamentally prompted the enlightenment, the birth of democracy, and in the last century, international law and commerce. The trustworthy have nothing to fear from the wicked, and in fact, their communities will continue to “roll forth unto the ends of the earth, as the stone which is cut out of the mountain without hands shall roll forth, until it has filled the whole earth” (D&C 65:2).

[1] William E. McCarthy, “The REA Accounting Model: A Generalized Framework for Accounting Systems in a Shared Data Environment” The Accounting Review, Vol. 57, No. 3 (Jul. 1982), pp. 554-578. Published By: American Accounting Association. See also Cheryl L Dunn and William E McCarthy. “The REA Accounting Model: Intellectual Heritage and Prospects for Progress” The Journal of Information Systems (Spring 1997), pp. 31-51

[2] Kip M. Twitchell, “A Proposed Approach to Minimum Costs for Financial System Data Maintenance.” Ledgerlearning.com. April 2018, at https://ledgerlearning.com.

[3] Eric L Denna, et al., Event-Driven Business Solutions, Today’s Revolution in Business and Information Technology, (Homewood, IL: Business One Irwin, 1993). See also Anita Sawyer Hollander, Eric L. Denna, J. Owen Cherrington, Accounting, Information Technology, and Business Solutions 2nd ed. (© McGraw-Hill Companies Inc.: 2000).

[4] Kip M. Twitchell, Balancing Act: A Practical Approach to Business Event Based Insights, xii + 348 pp. Illus., index. Delta Summit Imprint, 2011, 2015, p. 4.

[5] Kip M. Twitchell, “Transformation of Business and Financial Platforms: What We Must Understand to Renew Existing Systems.” In 2022 Fourth International Conference on Blockchain Computing and Applications (BCCA), pp. 312-316. IEEE, 2022.

Attempting to overcome the lack of knowledge of these principles, in 2016 I started a vlog, Conversations with Kip, and in 2018, a blog, LedgerLearning.com, each with hundreds of posts and tens of thousands of views (per YouTube and WordPress statistics maintained by the author).

[6] See “About Us” on Sharealedger.org https://sharealedger.org/?page_id=21.

[7] Sunde, Torje Vingen, and Craig S. Wright. 2023. Implementing Triple Entry Accounting as an Audit Tool—An Extension to Modern Accounting Systems. Journal of Risk and Financial Management 16: 478. https://doi.org/10.3390/ jrfm16110478

[8] Kip M. Twitchell, “Blockchain and the Next Generation ERP Systems” video, September 11, 2017.

[9] Kip M. Twitchell, “Blockchain Gap: Trust and Efficiency” video, February 4, 2019. See also Kip M. Twitchell, “Blockchain, Trust and Efficiency,” video and “Blockchain, Trust and Efficiency” blog entry, Dec 9, 2019 and “Blockchain Gaps” series from 2018.

[10] Alfred W. Crosby, The Measure of Reality: Quantification in Western Europe, 1250–1600, xiii–xiv. Cambridge: Cambridge University Press, 1996, p. 199.

[11] Kip M. Twitchell, book draft, Virtue Wheel Chapter 1 “The Power of Virtues” at virtuewheel.com/.

[12] Luca Pacioli, Particularis de Computis et Scripturis(1494): A Contemporary Interpretation, translated by Jeremy Cripps, Pacioli Society, Seattle, 1994, p. 1

[13] Kip M. Twitchell “Luca Pacioli & Business Ethics” blog entry, May 7, 2018. See also “Attributes of Financial Reporting and Financial Reporters,” blog entry, November 25, 2020.

[14] Alfred W. Crosby p. 14 as quoted in “Virtue verses Values” Virtue Wheel blog entry, March 18, 2019. See also “Historical Accounting’s View of Blockchain Ledgers,” Ledger Learning blog entry, August 6, 2018.

[15] Kip M. Twitchell, “Simple Financial System Proof of Concept” blog entry, December 13, 2019.

[16] The Church of Jesus Christ of Latter-day Saints, Topics and Questions: Overview, Tithing, accessed September 2024.

[17] The Church of Jesus Christ of Latter-day Saints, Topics and Questions: Overview, Fasting and Fast Offerings, accessed September 2024.

[18] The Church of Jesus Christ of Latter-day Saints, The Doctrine and Covenants of The Church of Jesus Christ Of Latter-Day Saints, Section 104:67–75. Page 210.

[19] This is based upon a talk in 2006 by the Chicago Temple president, Glenn Hansen, who explained that the Church’s temple endowment highlights progression of the modern Church. Early days were about obedience, and then sacrifice, perhaps ending with the Manifesto in 1890. Next was the basic laws of the gospel, perhaps ending with the revelation on the priesthood in 1978. We clearly are currently learning about the law of chastity. Next, we will learn more about the law of consecration. Kip M. Twitchell, personal journal, Friday, July 21, 2006, president name per churchofjesuschristtemples.org. See also General Handbook: Serving in The Church of Jesus Christ of Latter-day Saints Section 27.2 “The Endowment” © 2020, 2024 by Intellectual Reserve, Inc.

[20] The Church of Jesus Christ of Latter-day Saints, Preach My Gospel: A Guide to Sharing the Gospel of Jesus Christ, chapter 8 page 150. President Monson’s quote is from “Thou Art a Teacher Come from God,” Improvement Era, Dec. 1970, 101.

[21] The Church of Jesus Christ of Latter-day Saints, “Starting and Growing My Business for Self-Reliance.” Chapters which touch upon financial reporting are italicized below.

1: My Readiness for Business Success

2: Solving Unmet Customer Needs

3: Ensuring That I Have a Profitable Business

4: Finding Customers

5: Keeping Customers

6: Managing the Profitability of My Business

7: Keeping Separate My Business and Personal Money

8: Managing the Cash Flow of My Business

9: Growing My Business

10: Financing My Business

11: Continually Improving My Business

12: Presenting My Business

[22] In the US the most ubiquitous tool might be QuickBooks, yet it provides no free starter plan, unlike social media platforms, and with a market capital of 174 billion it is not in the same category of platform as Facebook at 1 trillion (Google finance search 9/2/2024).

[23] Functionality of the stewardship account could be expanded to include simple ERP functions beyond basic cash management perhaps using an open-source ERP package model such as OFBiz. See also See also William E. McCarthy, Guido L. Geerts, and Graham Gal, “The REA Accounting Model as an Accounting and Economic Ontology” American Accounting Association monograph, 2022

[24] See Kip. M. Twitchell, “The Mainframe, Open Source And Renewal of Financial Systems” blog entry, February 26, 2021.

[25] Sunde, Torje Vingen, et al. page 4.

[26] See also William E. McCarthy, et. all, “The REA Accounting Model as an p. 87

[27] Twitchell, Kip M. “Sharealedger.org: My Report to Dr. McCarthy on REA Progress,” guest lecture at Michigan State University, April 15, 2020. See also McCarthy’s most recent monography, discussed during this video presentation, William E. McCarthy, et. al, “The REA Accounting Model as an Accounting and Economic Ontology” p. 88

[28] Felix Martin, Money: The Unauthorized Biography. New York, Alfred A. Knopf, 2014 pp. 198–199. And 22–26..

[29] The Church of Jesus Christ of Latter-day Saints, Church History Topics: The Kirtland Safety Society, accessed September 2024.

[30] Kip M. Twitchell, “Blockchain, Trust and Efficiency” blog entry, Dec 9, 2019,

[31] Kip M. Twitchell “The Future of Social Commerce” unpublished white paper, June 2017. See also blog “Social Commerce” series from 2017 “Social Banking” series from 2018 and “Fintech” series from 2017.

[32] See “Simple Financial System Proof of Concept” blog entry.

[33] GiveDirectly, Inc. 501(c)(3) Non-Profit, “Research on cash transfers” December 22, 2020.

Leave a Reply