The second in a series of videos about financial system transformation in financial services, this time deal with platform considerations. In the last video, we talked about source system data considerations–getting your data into the new platform. This time it’s all about the platform itself.

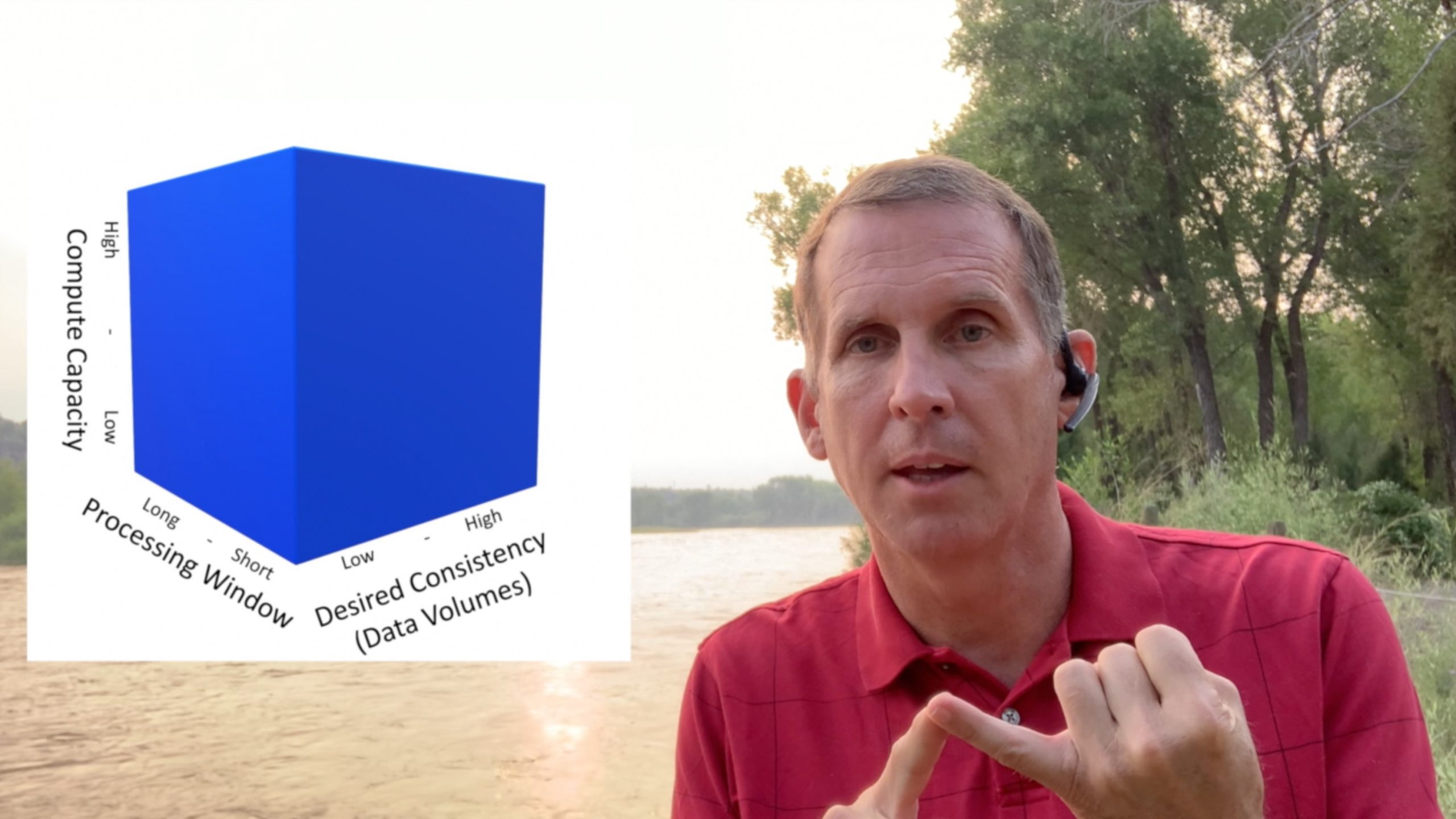

Dimensions of the Problem

The dimension of the problem can be classified as:

- The compute capacity for the platform

- The processing window available

- And the level of desired consistency for the various perspectives

Out of these three, number three is the one we have varied the greatest in the financial systems that have been constructed. Let’s examine each of them

Compute Capacity

The compute capacity of the platform is in some cases equal to its cost. This is the amount of money one is willing to spend to solve the problem in a given time.

Not all platforms are equal; they don’t all scale at the same rates. For some problems more compute capacity does not equate to faster. Certain configurations can lose substantial amounts of capacities the more and more resources they have to manage.

Processing Window

The processing window is the amount of time the platform has to solve the problem. Understanding the daily financial cycle is critical to these kinds of problems. The enterprise balances must be produced for the opening of business the next day.

There is a trade-off between the platform capacity, and the processing window. More processing capacity can open up a greater processing window. But not all the tasks in creating enterprise balances are subject to potential parallelization. In other words, some tasks must be serially performed. Understanding this is important in selecting or building the platform.

Target Data Consistency

Although there are choices that can be made in the capacity capacity and the window parameters, by far the parameter with the great possible variability in the level of data integration or consistency across the various perspectives the platform must support.

In the last blog entry, we explained what data perspectives mean when it comes to financial data. If all the perspectives are independent and unique, then the processing of them can be done in parallel. This is what has historically been done with our financial reporting applications.

But if greater integration and consistency is required, then greater attention needs to be paid to where the consistency is important, and how to prepare the financial data to support each one of them.

Risks and Rewards

Organizations do not undergo major transformations to have the same capabilities and and costs: They want higher capabilities and lower costs.

If the three parameters aren’t understood well, it is possible to build a new platform with lower capabilities and higher costs.

The key system in today’s financial reporting is the General Ledger. Understanding how it works, what perspectives it contains, what data they come from, and the timing involved in producing it are all critical.

This is episode 254 of Conversations with Kip, the best financial system vlog there is. Literally learn more–about ledgers and financial systems–at http://www.LedgerLearning.com

Previous video in the series

Next week’s video

Leave a Reply